Dive Brief:

- Beneficiaries eligible for both Medicare and Medicaid who choose privately run Medicare coverage, called Medicare Advantage, receive more care and a higher quality of care while costing their insurers less, according to a new analysis from healthcare consulting firm Avalere.

- Dual eligible beneficiaries attended roughly 12% more office visits than their counterparts in traditional Medicare, yet accounted for a 33% lower rate of hospitalizations and 42% fewer emergency room visits, respectively. Dual eligible MA members also received more preventive care and had significantly lower rates of health complications than those in fee-for-service Medicare, according to Avalere, which analyzed 2015 Medicare claims data from beneficiaries with one or more of three chronic conditions: hypertension, hyperlipidemia and diabetes.

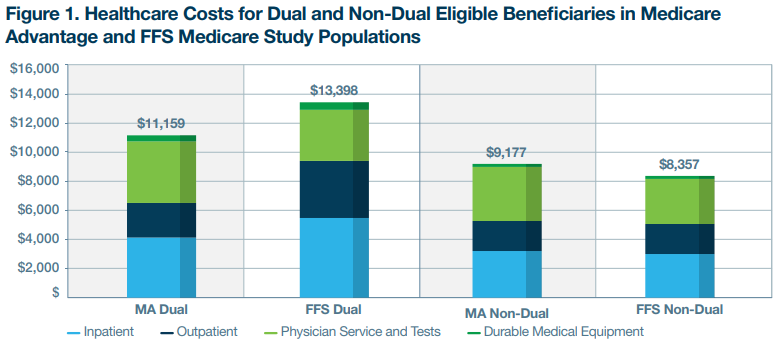

- Despite their poorer health outcomes, dual eligible FFS Medicare beneficiaries had an almost 17% higher cost of care than those in MA, driven by higher spending in hospital inpatient and outpatient services, Avalere found. Contrastingly, dual eligible MA patients spent more on physician services and medical tests, in line with their higher use of preventive care services.

Dive Insight:

The dual eligible population makes up 20% of Medicare and 15% of Medicaid enrollees, according to CMS, but disproportionately accounts for 34% of Medicare and 33% of Medicaid spending. Dual eligible patients are more likely to be affected by social determinants of health factors, such as poor air quality, lack of transportation and a shortage of healthy food, which can cause or exacerbate high-cost medical issues like chronic conditions.

In Avalere’s analysis, MA comes out ahead of traditional FFS in meeting the needs of this high-cost, high-need demographic. Avalere found dual eligible MA members also had higher rates of testing for cholesterol and preventive breast cancer screenings and similar rates of HbA1c testing, a blood test for diagnosing and controlling diabetes.

Dual eligible MA beneficiaries saw a roughly 24% lower rate of avoidable hospitalizations, and those with diabetes saw 49% fewer overall complications (and 71% fewer serious ones). It wasn’t a full sweep for MA, however. Dual eligible FFS Medicare members had a slightly lower chance of being readmitted to the hospital.

Avalere found the MA population was more likely to include dual eligible and low-income and racial or ethnic minority beneficiaries, as well as those with disabilities, serious mental illness and substance abuse. All are factors associated with poorer health overall, suggesting the study’s results may underestimate MA’s performance relative to FFS Medicare.

Avalere

However, there’s evidence MA is lower cost because seniors that switch into the privately run insurance plans already account for lower costs. The Kaiser Family Foundation found earlier this month people who selected MA plans in 2016 spent 13% less in healthcare-related costs the year before than those who remained in traditional Medicare, including those with chronic conditions.

Avalere’s most recent brief didn’t look into this, researcher Christie Teigland told Healthcare Dive, though she noted that analysis doesn’t make sense in light of the fact that MA beneficiaries are more likely to be affected by social determinants of health factors.

“I think people generally think the Medicare Advantage population is less sick, and our data shows that is absolutely not the case,” she said. “This demonstrates the promise of Medicare Advantage, which is that you coordinate care you’ll be able to prevent those worse health outcomes.”

MA plans cover roughly 35% of the seniors in Medicare, a percentage that’s only expected to grow due to the popularity of the value-based, comprehensive plans. Over the past few months, CMS has worked to expand both the profitability and the offerings of the plans, releasing a final rule in April hiking payment rates by more than 2.5% and adding regulatory flexibility to expand telehealth and social determinants of health benefits.

Top image credit: Getty Images